Here Comes The Next Gold Rush

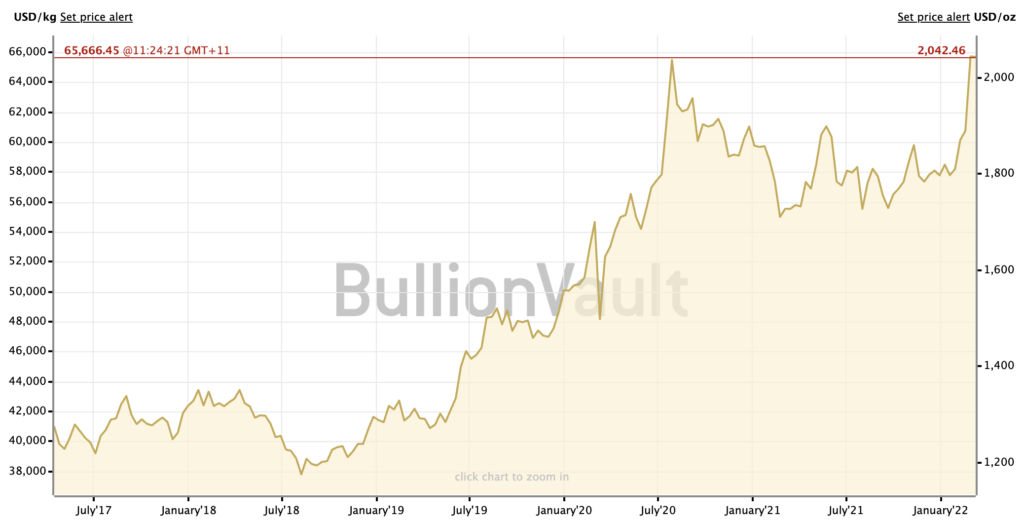

As growing global economic uncertainty rises, the price of Gold has surged to its highest price in decades at over US $2000 per ounce. Rising by approx. 17% in the last 12 months, Gold is seen as a stable and valuable investment amidst stock market volatility, global currency fluctuations, and the looming threat of inflation.

With this recent Gold rush, it is more important than ever for jewellers, pawnbrokers, and other precious metal dealers to ensure they are getting the best value for their products. This is where the Niton XL2 comes in – with its industry-leading accuracy and precision, the Niton XL2 helps dealers test and grade their gold quickly and easily, ensuring they are getting the most value for their products.

What’s Causing the Spiking Gold Price?

There are a number of factors that have contributed to the recent surge in gold prices. Some of these include:

1. Uncertainty in the global economy – The recent Russian-Ukrainian conflict has led to fears of inflation and a flight to safer investments, such as gold.

2. Low interest rates – when interest rates are low, gold becomes more attractive as an investment since other options offer relatively low returns.

3. Increased demand from emerging markets – as developing economies continue to grow, there is an increasing demand for gold jewellery and other luxury items.

4. Limited supply – The Russian-Ukrainian conflict has caused many investors to worry about potential disruptions to the global supply of gold, with Russia being the world’s 3rd largest producer of Gold.

What Does This Mean for Gold Trading?

The recent increase in gold prices is likely to lead to increased trading activity in the near future. This could present a great opportunity for investors who are looking to capitalise on the trend. While some volatility is to be expected, gold is still seen as a relatively safe investment, especially in times of political and economic uncertainty.

The Importance of Accurate Gold Testing

In order to make informed investment decisions, it is important to use accurate gold testing methods. This is especially true in light of the recent price increase, as there is a higher potential for fraud and misrepresentation.

There are a number of different gold testing methods available, but not all of them are reliable. In some cases, inaccurate results can lead to costly mistakes. Here are some of the most common methods that can often be inaccurate:

Gold Testing with Acid

One of the most popular gold testing methods is acid testing. This involves dissolving a small amount of gold in acid and observing the reaction. If there is a precipitate, the metal is considered to be gold.

While this test can be used to determine the presence of gold, it cannot be used to accurately measure its purity. As a result, it is not recommended for use in trading.

Gold Testing with Fire

Another common gold testing method is fire testing. This involves heating a sample of gold until it melts and then observing the colour of the flame.

However, this method is also ineffective because different alloys will produce different colours in the flame.

Gold Testing with a Magnet

Another inaccurate method of gold testing is using a magnet. This involves placing a small sample of gold near a magnet and observing the reaction. If the metal is attracted to the magnet, it is considered to be gold.

This test is not always accurate because other metals, such as iron, can also be attracted to magnets.

How to Ensure Accurate Gold Testing

The most accurate way to test gold is through the use of a precious metal analyser. This device uses a range of sophisticated sensors to measure the purity and composition of gold accurately. As a result, it is the preferred method for traders and investors who want to ensure accuracy in their transactions.

Precious metal analysers are not always easy to use, but with the right training, they can provide accurate and reliable results. By using a precious metal analyser, investors can be sure that they are getting the best possible value for their money.

For Fast & Accurate Analysis Look No Further Than the Niton XL2 & DXL

When it comes to fast and accurate gold analysis, the Niton XL2 & DXL precious metal analysers are the tools of choice. With their range of sophisticated sensors, the XL2 & DXL can provide traders and investors with precise results in seconds. This makes it the perfect device for taking advantage of the recent spike in gold prices.

The Niton XL2 & DXL are also easy to use, with a simple interface that makes it easy to get the most out of your analysis. Whether you are a trader or an investor, the Niton XL2 and Niton DXL can ensure accuracy and precision in your gold transactions.

PAS are exclusive suppliers of the Niton XL2 and DXL Precious Metal Analysers in Australia, New Zealand and PNG. If you’re looking to take advantage of this price spike and improve the reliability of your operation, these analysers are essential.

Give us a call today to find out more about our gold testers and discuss the benefits to you.